Last Day Left! Apply before 21st February 2026 to enroll in the final batch. Call now: 9112-207-207

Financial Modelling and Valuation Certificate by EY- 40 Hrs

Elevate your expertise in Financial Management with a specialized module on Financial Modelling and Valuation delivered by EY, one of the world’s leading professional services firms. Gain cutting-edge skills in financial modelling, valuation, and Excel techniques through this program, designed by senior professionals from EY and industry experts. The module provides candidates an exposure to create efficient, robust and flexible financial models to perform independent business valuations.

Get in touch +91 9112-207-207

- Understanding of Excel screen, copy & paste, Navigation Shortcuts

- Page Setup, Calculation modes

- Cell formatting, Sorting & filter data

- Mathematical functions

- Statistical functions

- Financial functions

- Logical functions

- Lookups and Reference functions

- Text functions

- Data and information functions

- Difference between financial models and spreadsheets

- Financial model structure - flow of the model, deciding on the order in which sheets should be prepared and presented

- Creating a template for the financial model

- Timelines, flags, and counters

- Developing P&L, Balance Sheet & Cash flows - line items and drivers

- Understanding contra accounts

- Constructing Revenue items

- Expenses - fixed costs (rent, insurance, electricity & utilities, etc)

- Expenses - variable costs (employee costs, power and fuel, advertising and marketing, etc)

- Revenue and expenses for sectors that are covered by regulatory authorities (power, telecom, roads, etc)

- Tangible fixed assets account - break-up, capital expenditures, asset lives, impact of foreign exchange translation

- Treatment of intangible fixed assets

- Depreciation and amortization - straight-line method, written-down value method, units of production method, and other methods

- Depreciation for books vs. depreciation for tax

- Capital structure and introduction to debt modelling - types of structures, types of debt, types of equity, treatment of grant, reviewing terms of debt

- Setting up inputs, flags, and counters for debt calculations (considering repayment pattern, moratorium, etc)

- Setting up priority of payments and arriving at repayment profile for debt when there are multiple debts in the project (senior debt, sub-debt, etc)

- Understanding sculpted repayments

- Modelling to check for debt covenants

- Understanding the debt service reserve account (DSRA) and setting it up

- Construction cost, timeline, and delays in infrastructure projects

- Introduction to VBA - creating a simple macro

- Treatment of interest during construction (circularity and how to break it) and Equity Schedule

- Understanding Working Capital

- Modelling of Working Capital

- Tax calculations (Income tax and Minimum alternate tax)

- Understanding and calculating deferred tax

- Integrating the financial statements - preparing Profit & Loss Account, Balance Sheet, and Cash Flow Statement and setting up dividend calculations

- Handling aggregation, consolidation, and switches when there are multiple assets and/or entities

- Understanding adjusted EBITDA and Pro Forma EBITDA

- Building flexibility to evaluate sensitivities on various parameters

- Calculation of key ratios and margins

- Goal Seek, Setting up checks in the model

- Incorporating overrides for various assumptions

- Introduction to charts - simple and advanced charts

- Creating dashboards that present the key assumptions and outputs of the model in a meaningful and decision-oriented manner

- Introduction to valuation concepts - PV, NPV, IRR, FCFF, FCFE, etc

- Introduction to valuation methods - Discounted cash flow method, difference between NPV and XNPV, IRR and XIRR formulas

- Introduction to valuation methods - comparable companies methods (trading multiples and transaction multiples)

- Introduction to valuation methods - book value method (net asset value - NAV - and adjustments to NAV)

- Detailed understanding of discounted cash flow method, calculation of WACC

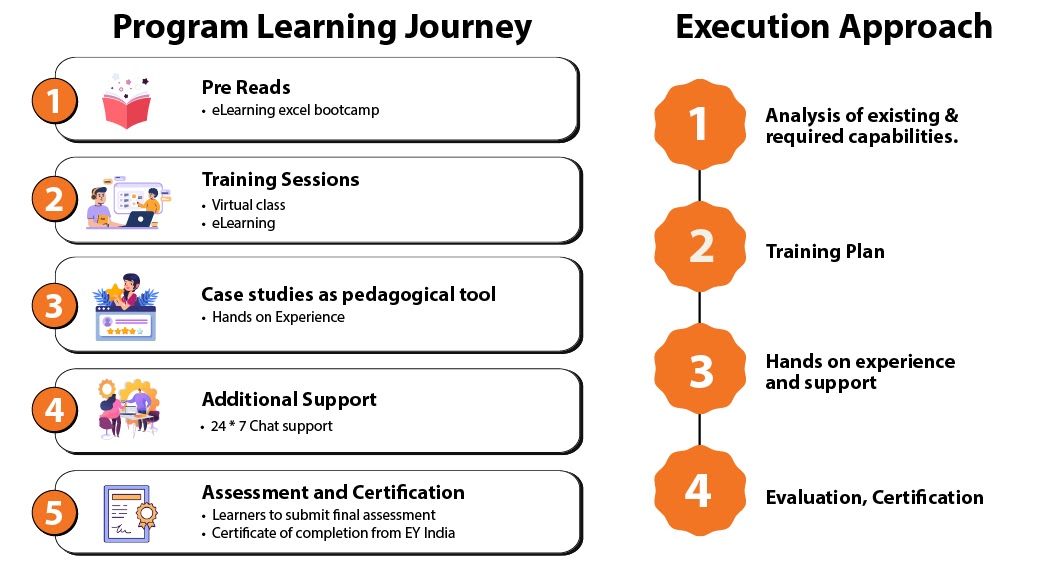

1. Module 1 will be eLearning and Modules 2-10 will be Virtual Instructor Led Training.

2. To access all the live sessions, the learner will have to access the link from the MITSDE LMS. However, all learning materials and reading materials of the EY Financial Modelling and Valuation Certification Program will be available on the EY LMS.

3. All learning materials and reading materials of the PGDM COURSE will be available on the MITSDE LMS.

Tool Used

About

PGDM In

Finance

Management

Financially viable companies have to manage cash flows effectively so that they do not drain out on finance and keep the working capital running to cover the day-to-day operational expenses. A growth spurt in the banking, insurance, and venture capital markets have triggered an expansion in the global and Indian financial sectors. This has effectively pushed the finance management stream as an in-demand area of employment.

The PG Diploma in Finance Management is suitably designed to take advantage of the emergent financial sector. The course prepares you for relatively new finance-associated jobs that are finding their way in the new digitized world. The program takes you through the key concepts of financial management and gives you enough coverage to perform at all levels of bookkeeping, financing, cash flow, budgeting, accounting, reporting, etc. The curriculum of this course is designed by a team of experienced finance and academic professionals from various domains taking into consideration the latest developments and trends in this arena.

Unique Pedagogy

MITSDE's distance learning programs are meticulously designed to bridge the skills gap for working professionals. Our curriculum is constantly updated to reflect the latest trends in management, industry requirements, dynamic business environments, and burgeoning technological advancements. The PG programs are co-created with industry experts and subject matter authorities, ensuring content aligns with real-world applications. You have access to interactive tools, e-books, multimedia content, and comprehensive reference materials.

Academic Partnerships

Launch your global career with MITSDE. Partner with us to gain industry-leading expertise from renowned institutions. Our curriculum integrates global best practices, equipping you with the skills and connections to thrive on the international stage. Graduate with a competitive edge and unlock a world of career possibilities.

Expert Faculty

The MITSDE faculty consists of several academic luminaries and seasoned industry experts, ensuring you receive a well-rounded education grounded in real-world application. These experts actively engage with students through interactive webinars and doubt-solving sessions. This direct interaction bridges the gap between theory and practice, giving you the opportunity to ask questions, clarify concepts, and gain valuable insights directly from professionals at the forefront of your chosen field.

Learning

Outcomes

Course Syllabus

| S.No | Code | Subject | Credits |

|---|---|---|---|

| 1 | S1C10 | Managerial Economics | 4 credits |

| 2 | S1C03 | Business Communication | 4 credits |

| 3 | S1C06 | Legal and Business Environment (Micro and Macro) | 4 credits |

| 4 | S1C15 | Accounting for Managers | 4 credits |

| 5 | S1C01 | Principles of Management | 4 credits |

| S.No | Code | Subject | Credits |

|---|---|---|---|

| 1 | S2C14 | Research Methodology and Management Decision | 4 credits |

| 2 | S2C13 | Management Intelligence System | 4 credits |

| 3 | S2C12 | Financial Reporting, Statements, and Analysis | 4 credits |

| 4 | S2SF1 | Financial Management | 4 credits |

| 5 | S2SF2 | Strategic Cost Management | 4 credits |

| S.No | Code | Subject | Credits |

|---|---|---|---|

| 1 | S3C01 | Strategic Management | 4 credits |

| 2 | S3C02 | Organizational Behaviour | 4 credits |

| 3 | S3SF01 | Financial Markets and Services | 4 credits |

| 4 | S4EB3 | Security Analysis and Portfolio Management | 4 credits |

| 5 | S3SF03 | Corporate Finance | 4 credits |

| 6 | PWMI1 | Project Work | 6 credits |

| Value Added Skill Certificate - 2 credits |

| S.No | Code | Subject | Credits |

|---|---|---|---|

| 1 | S4SF1 | Mergers and Acquisitions | 4 credits |

| 2 | S4SF2 | International Finance | 4 credits |

| 3 | S4SF3 | Financial Analytics | 4 credits |

| 4 | - | Elective 1 | 4 credits |

| 5 | - | Elective 2 | 4 credits |

Elective Basket (4 Options , Choose any 2)

| S.No | Code | Subject |

|---|---|---|

| 1 | S4EM4 | Marketing of Financial Services |

| 2 | S4EB4 | Behavioural Finance |

| 3 | S4EF2 | Wealth Management |

| 4 | S4EF3 | Investment Banking |

- The above course curriculum is subject to revision as per AICTE guidelines from time to time and as per industry updates.

- Exams would be conducted during the January and July exam cycles.

- All the Exams at MITSDE (Internal & External) are in the form of Multiple Choice Questions.

- Student will have to attempt all the components in the Learning Management System and submit TWO Quizzes (30 marks each) for each subject.

- Internal Examinations carry 60% marks (2 Quizzes of 30 Marks each) and External Proctored Exam carry 40% weightage (passing criteria for both internal & external exam is 50%).

Program

Fees

₹ 96,000 /-

Enquire NowFees Options

- Installment 1

- Installment 2

- Installment 3

Course fee - Installment

- At the time of admission-₹ 26,000 /-

- Within 3 months - ₹ 35,000/-

- Within 6 months - ₹ 35,000/-

Course fee - Lumpsum

- Discount- ₹ 6,000 /-

- -

- Total Lumpsum- ₹ 90,000 /-

- Students are required to pay additional exam fee per exam per attempt and Project Evaluation Fees. For Installments

- First Installment needs to be paid at the time of admission.

- Second Installment needs to be paid within 3 months from the date of admission.

- Third Installment needs to be paid within 6 months from the date of admission

| S.No | Course Duration | Extension | Validity |

|---|---|---|---|

| 1 | 24 Months | 6 Months | 2 Years 6 Months |

A full-fledged course in finance management shall prepare you to take up challenging roles, namely:

- Credit Manager

- Financial Advisor

- Equity Analyst

- Tax Consultant

- Research Analyst

- Bank Manager

- Portfolio Manager

- Finance Manager

Frequently asked questions (FAQs)

- Our eLearning programs comprises of pre-recorded videos.

-

You can view the videos unlimited time up-till your validity timeframe i.e. 6 months from the date you are assigned the course.

-

Doubt solving support facility is available through email. You would be provided with a dedicated email ID where you can post your query

-

The sessions are recorded and delivered by EY professionals and Industry experts. The 32 hours of live sessions will be delivered by a mix of sector expertise and industry experts under the guidance of senior EY professionals with significant experience of training delivery.

-

You get 3 attempts to clear the assessment conducted by EY

-

The EY assessment would comprise objective questions

-

No, there is no negative marking for EY assessment.

-

You are required to score 60% to pass the assessment conducted by EY

-

You would be awarded with a certificate of completion.

-

You will be provided with 3 attempts and in case you are unable to clear in 3 attempts you will be given participation certificate instead of completion certificate.

-

No, soft-copy of certificate would be provided after successfully clearing the EY assessment.

-

EY certificate does not have any expiry.

-

You can take the assessment within 15 days of completion of the batch; however, eLearning access will stay active till 6 months from the date you have been assigned the course. In a situation where the participant is unable to clear the assessment in 1st attempt, 20 more days will be provided to clear the assessment with 2 more attempts.

-

LMS (Learning Management system) is the learning portal from where you will access your eLearning program.

-

No, we don’t provide any hard-copy material within our program.

-

Our pedagogy involves practical understanding with help case studies and relevant examples.

-

MIT will have a separate email id for all the student queries for this program which will be sent to EY every week. Mutual TAT: 12 days (to be discussed)

-

We provide you with EY presentations in the form of PDFs in support of the pre-recorded videos/live sessions.

The total duration of the course is divided as below:

eLearning

8 hours of excel program (eLearning)

36+ hours of eLearning Financial Modelling and valuation

Virtual instructor led training:

32 hours of virtual instructor led training on Financial Modelling and valuation.

Total Score: 100, Min Score for Qualification: 60%

Format:

Mix of numerical, concept testing and case scenarios

-

Finance professionals working in investment banking and equity research

Finance managers

Corporate finance, private equity and M&A professionals

CA, FRM, MBA finance, CFA course candidates

Self-employed finance professionals

Graduates

-

Candidate should have basic understanding on MS Excel which us also provided as part of the program. The prior excel knowledge will be helpful as the models will be prepared using advance excel tools.

-

No, the certificate is solely issued to you by EY.

-

No, the program does not comprise of any live projects but explains the concepts using the case studies and examples.

-

The course is basic to intermediate level

-

Yes, the course does not require you to be a CA/CS to apply for the course.

-

Best practices

Structuring and designing models

Sector-specific working of revenue and expense

Understanding various possible ways to compute different line items forming part of financial statements

Tax calculation

Integrating financial statements to present a cohesive output

building macros

Various approaches to valuation and how to apply them

Presentation of output in an appealing as well as meaningful manner

-

Investment Banking Analyst

Equity Research Analyst

Financial planning Analyst

Credit Analyst

Corporate Finance

Financial Analyst

Project Finance

-

Yes, case study is part of the curriculum which would be generic in nature.

-

VILT will give the students an opportunity to solve the case studies and create models with faculty and will also have the access to case solutions. Additionally, the case studies will be unique from eLearning material. Additionally, eLearning is the best platform to reiterate the concepts and practice the concepts as per the available time of the individuals.

Note: To access all the live sessions, the learner will have to access the link from the MITSDE LMS. However, all learning materials and reading materials of the EY Financial Modelling and Valuation Certification Program will be available on the EY LMS.

Please note that all learning materials and reading materials of the PGDM COURSE will be available on the MITSDE LMS.

12 Months

PGCM - Business Analytics

Become part of India's fastest growing Fintech Industry with our Professional course in Fintech

Course Fees

₹ 64,000 /-

12 Months

PGCM - Digital Marketing

Upgrade your skills with trending AI tools & become a top digital marketer!

Course Fees

₹ 64,000 /-

24 Months

PGDBA Operations Management

Get the World's Highest Accredited Lean Six Sigma (Green & Black belt) Certification

Course Fees

₹ 95,000 /-

24 Months

PGDM Project Management

Leverage your exceptional management skills with our PMP Prep course and land your dream job today!

Course Fees

₹ 90,000 /-

15 Months

PGDM Executive Modern Project Management

Aspiring to be a Project Manager? Take the first important step with the CAPM Prep course today!

Course Fees

₹ 95,000/-